Is Main Street Part of Your Next Decade?

A review of Codie Sanchez's "Main Street Millionaire" as it relates to a Timeless Leader's curation of commitments

Read Time: 9 minutes

TLDR: Main Street Millionaire is a business book that teaches how to buy and grow businesses, but also argues that Main Street needs more leaders. Will that be you? (Come talk about it at the Basecamp this Thursday!)

Hi Timeless Leaders,

There's a demographic wave building that most professionals are missing entirely.

It represents one of the most significant commitment curation opportunities of our lifetimes.

Right now, over 10,000 Baby Boomers reach retirement age daily.

Many own small businesses: laundromats, HVAC companies, storage facilities.

Some of these are strong, profitable businesses.

This is the backbone of local economies, and these entrepreneurs need an exit strategy. Otherwise their businesses close, and most often are replaced by a large multi-national firm or… nothing.

I picked up Codie Sanchez's Main Street Millionaire not so much as an aspiring business buyer, but as someone thinking holistically about the next decade.

Last December, I found myself listening to her book launch livestream while driving my daughter home from gymnastics during a rare California downpour.

Sanchez was speaking to a packed Texas church about economic revolution. In just a few minutes, it sparked questions about power, ownership, and fixed vs variable costs from my seven-year-old for the various businesses we drove past on El Camino Real.

It dawned on me just how much small, local businesses make up an integral part of our communities and an overlooked aspect of my own portfolio strategy.

Could this insight inform how I—and we—build the lasting legacy we care about?

The Portfolio Strategy Question

Here's a commitment curation challenge you might have:

You've built a respectable career. Accumulated some wealth. Developed expertise.

Now what?

The appeal of a steady job is real, especially in a volatile economy. Your own venture, whether you’re already working on it or merely dreaming about it, threatens to keep you in operator mode and likely earning less than you might make on the job market.

Your investments are locked up in index funds, retirement accounts, and maybe your primary residence.

None of this gives you a lot of flexibility, or helps you build the impact portfolio that you wish you could leverage to respond to the needs and opportunities of the world around you.

The current political moment has me pulling economic philosophy off the shelf that I’ve hardly touched since my undergraduate days at Haverford.

In The Road to Serfdom, F.A. Hayek observed: "We cannot blame our young men when they prefer the safe, salaried position to the risk of enterprise after they have heard from their earliest youth the former described as the superior, more unselfish and disinterested occupation."

The promise of a safe and prestigious job is hardly out there anymore, and meanwhile we see continued consolidation of wealth and power in fewer and fewer hands.

We want reliable income, a sense of purpose, and a connection to people.

What if all those things are available, just around the corner?

What MSM Teaches About Business

I first encountered Codie Sanchez through her LinkedIn content. Her sassy, no-nonsense takes on business ownership cut through typical entrepreneurship noise.

When I heard she'd written a comprehensive guide, I was curious. Not as someone looking to buy businesses immediately, but as someone thinking strategically about economic participation.

What I found was surprisingly thorough.

This isn't motivational fluff. Sanchez built a tactical manual for people serious about business ownership. Complete with frameworks, evaluation criteria, and hard-earned lessons from her own failures.

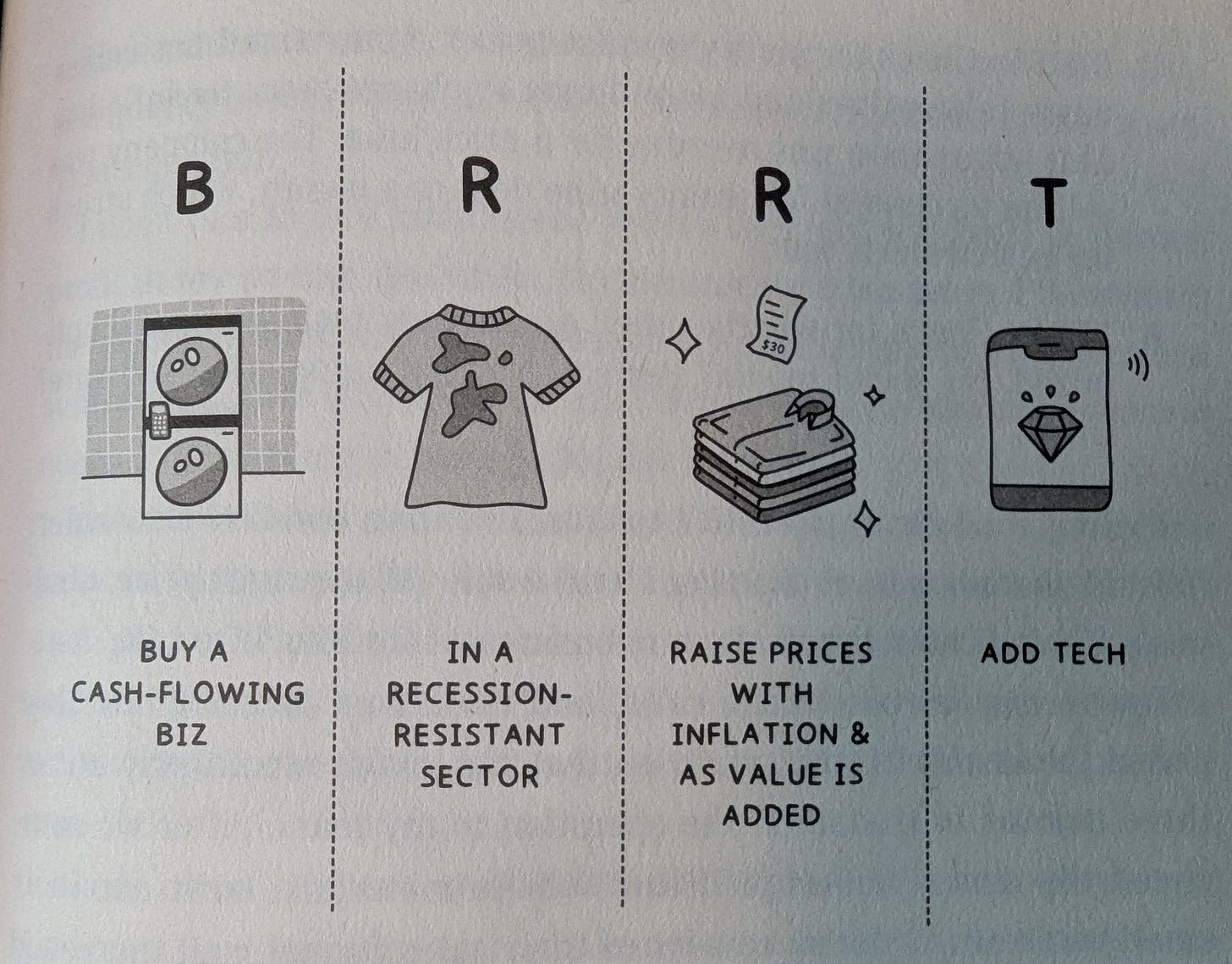

The book breaks down into four core chapters, each packed full of practical advice for business acquisition, transition, and scale. Using the acronym “RICH”, Sanchez outlines the process of building wealth and resilience with Main Street businesses in four phases:

Step 1: Research

My favorite, simple suggestion is the "Walking Billboard Strategy": "Every time you meet someone, tell them you buy businesses. Every time you walk into a small business, compliment them on the biz and ask if they own the place."

This is what it takes to learn the space. It also naturally turns into deal flow.

Layering on more discipline, she recommends evaluating prospects with three tests:

"SOWS" (Stale, Old, Weak, Simple)

BRRT (Buy, Resist, Raise, Tech)

Operator First (Is there enough profit to pay an operator Day 1)

Her diligence process includes 19 steps. She’s also very clear not to do it alone: “Don’t keep the details all to yourself. Run your terms by experts before you sign.”

Otherwise you could find yourself in situations that she describes being in like one where she lost $12 million to a "CEO [who] was not who he appeared to be... he was using company funds to rent apartments for his mistresses. Not one, but two."

Step 2: Invest

In this chapter she focuses heavily on seller financing. "I want you to remember these two words: seller financing. That is the debt strategy that wealthy people use, which will allow you to buy your first business with little money down."

She compares this to alternatives (loans, various acquisition strategies) with steps to follow and pros and cons for each.

I'll admit the financing side of business management is one of my weaker areas, so I wouldn’t likely catch issues in this section unless it were glaring.

Obviously if you are buying businesses you should work with professionals — but this book might prove to be helpful too!

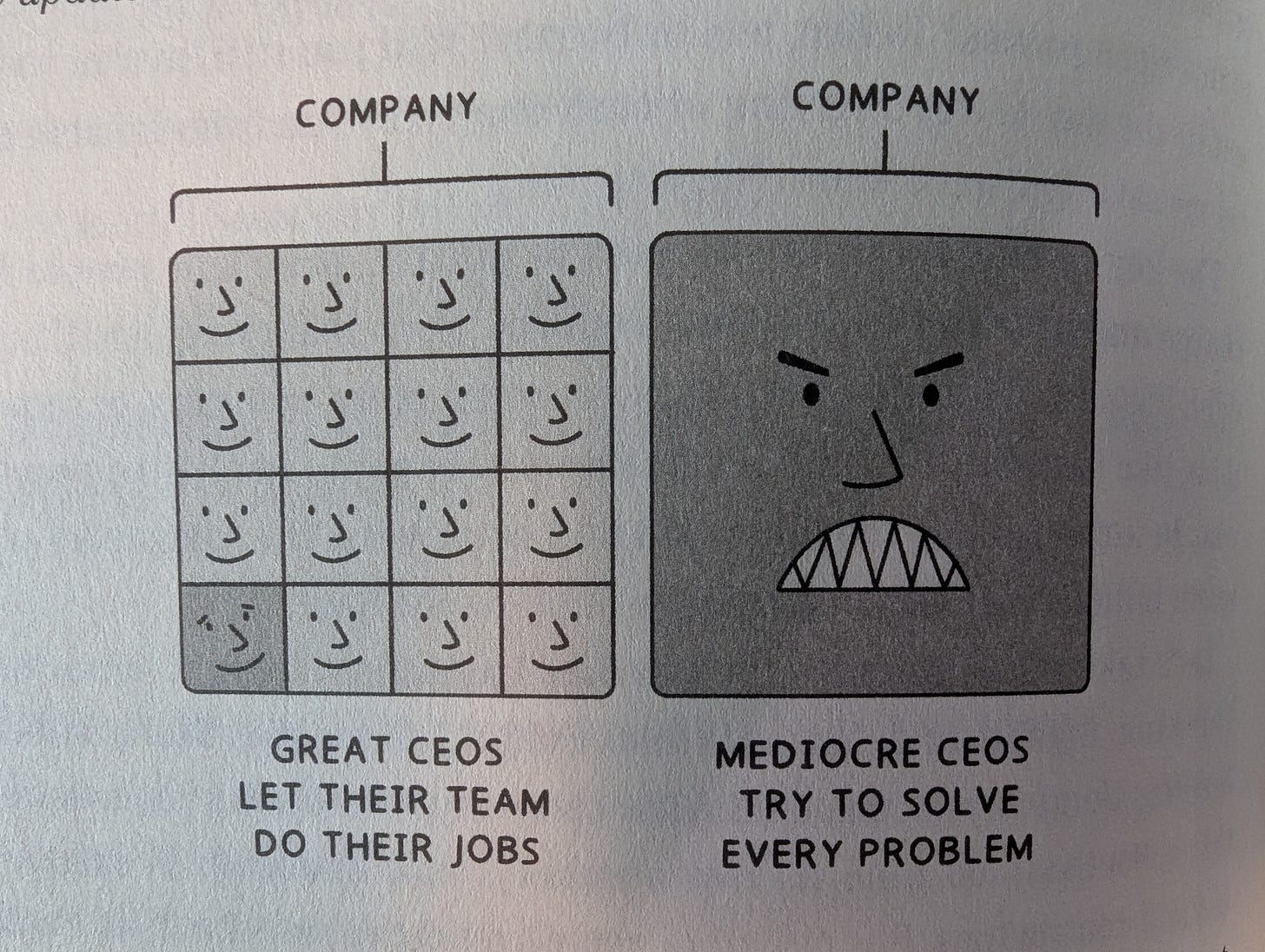

Step 3: Command

Once a business is purchased, you need to take over. In “Command,” Sanchez emphasizes practical transition management.

From hiring the right operator to taking over an existing team, this chapter has everything from compensation recommendations and interview guides to internal comms strategies.

Her best advice, that applies to all kinds of business transitions?

"Don't assume you're smarter than the previous operator. You're not."

"If you think this is a four-hour workweek on Day 1, you are nuttier than Mr. Peanut."

Step 4: Harness

Once you (and your operator) are in charge, there’s the challenge of running and scaling the business. Given that I’ve spent the past decade largely focused on these sorts of operational challenges, I enjoyed seeing how Sanchez suggests that a skilled manager could take over and drive impact in a Main Street business.

She starts out by walking through a far-fetched but well argued approach to 10xing profit in one year (8 steps). A lot of it comes down to price and packaging changes and better customer engagement.

She also covers tracking and managing to KPIs, managing your team, and focus.

Its when she talks about focus that Sanchez's advice transcends business acquisition and becomes leadership philosophy.

She quotes Geoffrey Kent, who ran his business for sixty-one years. Kent said “The main ingredient is one we all have, but we rarely use it correctly: time.”

You build your portfolio over time.

What you focus on at any given time will determine what changes and progresses.

When you have a business to run, Sanchez suggests that you focus on the one business, and the few levers in that business that drive growth and profitability. From there, the way to continue the upward growth is to think inorganic and integrated. You’re trying to build a platform that delivers multiple income streams and are “interwoven as threads to a rug,” and she offers seven steps to build this platform with add-on acquisitions.

In her closing of the chapter, she talks about exits. To ensure a potential buyer is confident your business can run without you, you need seven ingredients to bake your “cash-out cake.” While you don’t work on this immediately, starting with the end in mind (we’re all going to die, and what you build will need to transition some time) is a good way to make sure the progress you make early doesn’t come crashing down later.

The Stakes: Beyond Personal Wealth

When my daughter asked about those businesses on El Camino, I reflected on the fragility of entrepreneurship and small business that drives American capitalism.

Since 2000, the U.S. has lost nearly 400,000 small businesses while adding just 50,000 large firms. Private equity now owns one in three local businesses.

Of course there’s a range in private equity: during my work with Alpine Software Group's CEO training program in 2023, I had the privilege of working with a PE group that did everything possible to be “people first” in their approach.

That said, even the most thoughtful PE firms have a mandate to buy and consolidate, and the broader trend toward consolidation creates a system level risk in sectors as diverse as healthcare, retail, agriculture, and manufacturing.

Classic economic theory has long established the risks of monopoly power, and it hits close to home when our favorite coffee shop closes and is replaced by a Starbucks, the housing stock is bought up by Blackstone, our doctors aren’t allowed to meet for more than 15 minutes, or our own jobs are replaced by AI that’s owned by a giant like Google or Amazon.

We feel the limits on our freedom economically at the same time as political freedom erodes.

Sanchez suggest we invest in Main Street as a solution to both.

As Amartya Sen argues in Development as Freedom (one of my favorite texts from my undergrad days), we can also go in the opposite order: "The exercise of basic political rights makes it more likely not only that there would be a policy response to economic needs, but also that the conceptualization of 'economic needs' itself may require the exercise of such rights."

Whatever order you go, now is the time to build an impact portfolio for freedom.

The Democratic Ownership Vision

In reviewing Main Street Millionaire today, we're not just talking about individual wealth building. We're talking about participating in what I call a democratic ownership society (I first introduced this concept in this post).

The goal isn't to replace exploitative large businesses with exploitative small ones. It's to demonstrate that businesses can generate returns while paying living wages, supporting communities, and building local resilience.

We can do this in small local businesses, both because there’s more organizational control, but also because maintaining a more diverse ecosystem of enterprises creates more choice for everyone.

As Sen notes: "The loss of freedom in the absence of employment choice and in tyrannical form of work can itself be a major deprivation."

You might be thinking—how does this apply to me?

I can’t say for sure, but here are a few ideas:

For corporate professionals wondering about their next decade: What if your expertise could create more impact in smaller, independent organizations where you actually influence direction?

For nonprofit and solopreneur types: What if tapping into a vibrant local economy could amplify your mission? Where willingness to pay remains high but opportunities for innovation and social justice remain largely untapped?

Maybe you want to go all in on this model. But you don’t necessarily have to.

To me at least, Codie Sanchez’s call to action gives me another possible path for how I build my financial, career, and impact portfolio over the next decade+.

Your Commitment Curation Exercise

Not everyone needs to buy a business.

But everyone should evaluate their exposure to Main Street over the next decade.

My recommendation: Read Main Street Millionaire if you're serious about understanding business acquisition.

More importantly, spend time with local business owners in your community. Ask how they're doing. Learn about their succession plans. Understand their pressures.

Then evaluate your own portfolio strategy (leadership, time, money, impact, etc):

What's your exposure to Main Street businesses now, and over the next decade? How could you increase it by at least 5%—of your time, wealth, or both?

This might mean:

Exploring business ownership opportunities

Consulting for local businesses rather than only medium-large enterprises

Shifting investment allocation toward local/community-focused funds

Building relationships with business owners in your community

Developing expertise that serves the Main Street economy

The question isn't whether you'll get rich buying local businesses.

It's whether you'll participate in building an economy where ownership is distributed rather than concentrated.

The demographic wave is real. The consolidation threat is accelerating.

Your next decade of commitments will either feed that concentration or help distribute economic power more broadly.

Which legacy are you contributing to?

-Joe

Quick Updates:

Basecamp Holiday Sale Extended: Get a full year of monthly Timeless Leader community calls for just $76 (down from $97) through Wednesday midnight Eastern. This month the theme is Independence. Hope to see you there!

Thursday Email Mastery: Week 3 drops Thursday with the 2x2 framework for organizing your complete email strategy. If you missed Week 2 on email as business backbone, catch up here.

Great summary. While most of the elements in the prescription are valid, some roll easier off the tongue than to do in practice. If you are taking your FIRST venture into small business ownership (which BTW is a whole lot different from owning a larger corporation) you should focus on buying one that is already profitable. While they won't earn you as much as a successful turnaround, the fact is that most of us are not turnaround experts. Buy one that has already proven itself in the market and can run itself while you learn the ropes before trying to tangle them all up. If you don't screw it up, it will retain its value and once you get the hang of it you can expand it, or sell it profitably to buy something else.

Nice I’ve been exploring this as part of my strategy as well, trying to decide whether to prioritize buying or building first then layering on the other to supplement / diversify. You know Main Street summit and permanent equity? An interesting space and community for this. Also lots of entrepreneurship by acquisition folks intersecting with boring businesses.